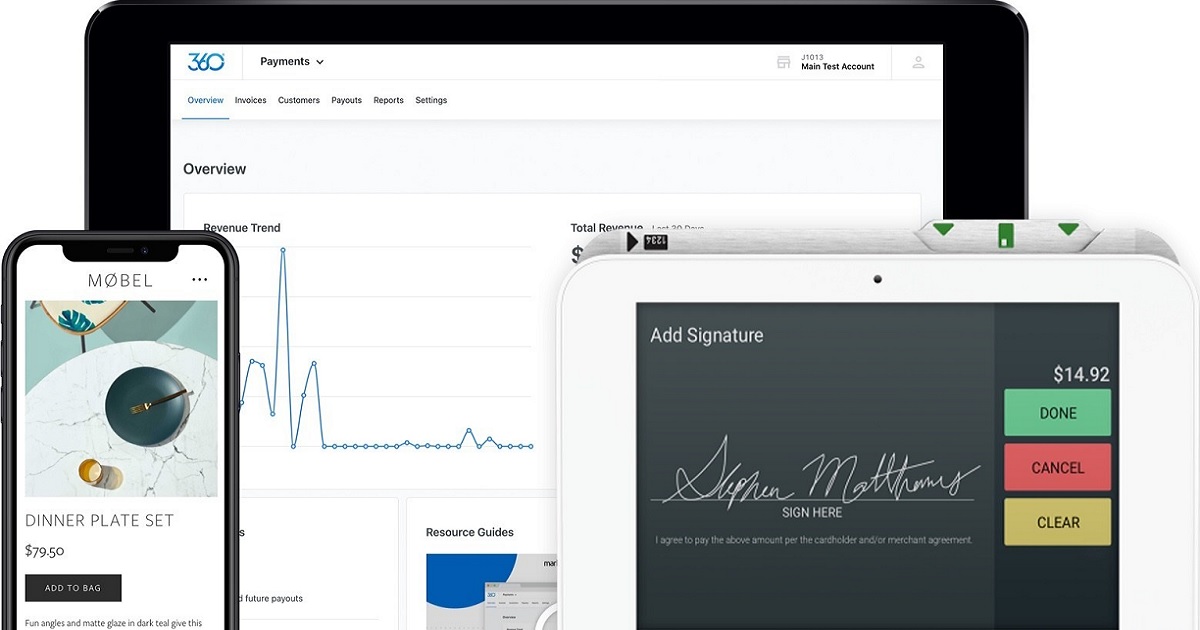

Madwire® Integrates Payments Tool with Its Marketing 360® Platform, Unifies Marketing & Payments for Small Businesses

Madwire®, a Colorado based technology company helping small businesses grow through their fully integrated business management and marketing platform, Marketing 360®, today announced the addition of payments to its existing suite of tools, allowing small businesses to easily and securely take and manage payments while unifying payment data under one integrated platform.